In association with Gumtree

Today I want to set you a challenge.

I’m calling it the £147.06 Gumtree challenge, but you’re allowed to change the amount. (I’m nice like that.) My amount is £147.06 because that’s how much it is costing for me and Belle to fly from Bristol to Ireland to stay with my sister over Christmas. We’ve been every year since they moved there and although we have flight costs, petrol and car parking, I easily make it back, eating my way through the Bendicks Mints and assorted savoury nibbles.

Still, it’s a chunk of money, and it’s always nice NOT to have to spend chunks of money if you can help it, so when Gumtree asked if I was up for a money making challenge, it seemed like a good idea to set myself a goal. I love a good goal – the more specific the better, as you will know if you’ve read my new ‘50 things to do before you’re 50‘ list.

We apply the whole SMART goals thing to business a lot – specific, achievable targets with measurable time frames – but it makes a lot of sense in all areas of life really. Take these two examples:

‘Ergh, I could really do with a bit of extra cash, I should probably clear out the garage sometime.’

‘I want to sell enough of the unwanted stuff around my home to cover £147.06 of flight costs before Christmas’

I know which one makes ME want to sort through my garage more.

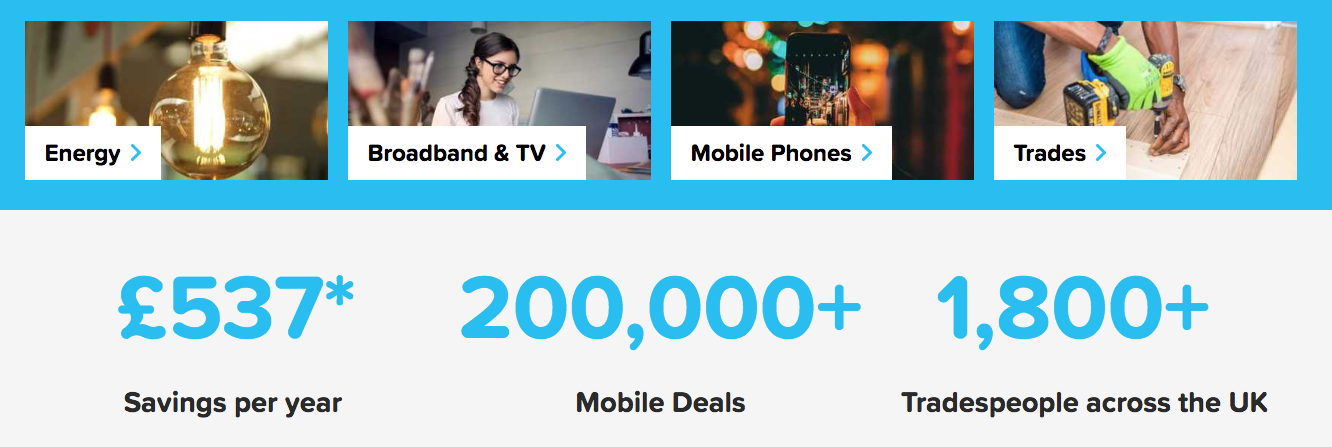

So where to start? The good news is that if you hoard an average amount of clutter, chances are you easily have £147.06 worth of unwanted stuff lying around the house, in your attic, or out in the garage. According to research carried out by Gumtree, households selling unwanted and unused items have made an average of £378 in the last year, and on average we’re potentially sitting on £881 per household – that’s not bad for a poke around the attic and an hour or so on Gumtree is it?

I was at a slight disadvantage starting the challenge as I’m one of those annoying people who says things like ‘Ooh, clearing out the wardrobe is just so relaxing!’ There is nothing more stressful for me than an untidy cupboard, so I’m already pretty streamlined. Still, in a way this proves the point even better – if I can find things to sell on Gumtree then anyone can.

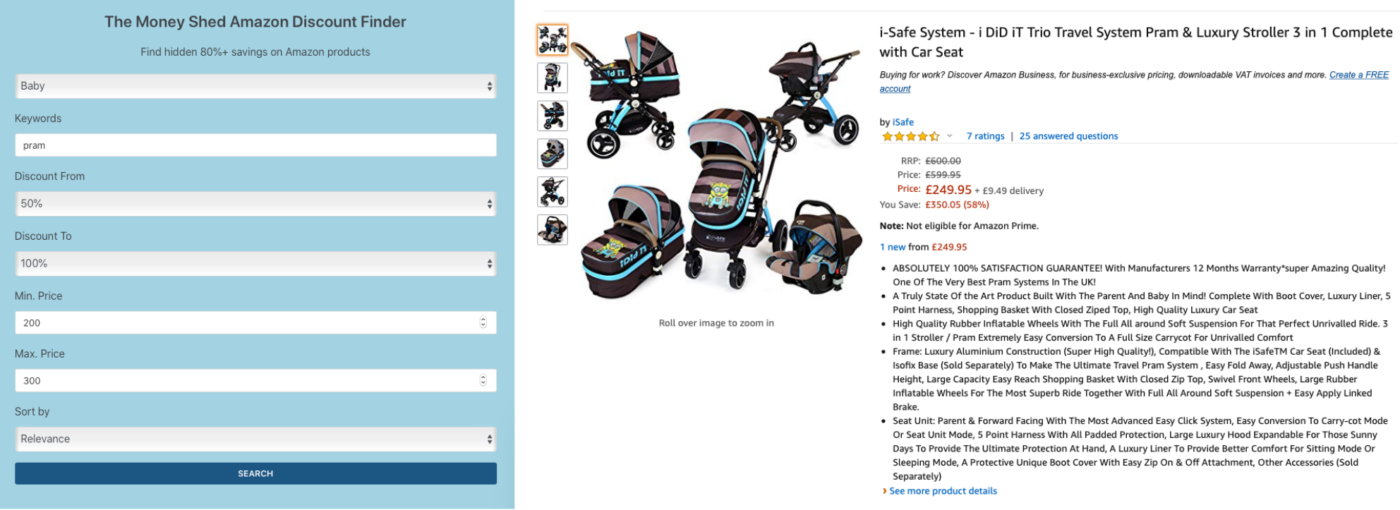

I’ve actually used Gumtree quite a bit over the last few years. Scrolling back through my account I’ve sold all sorts – a fish tank, a pink ukulele, an air purifier, chests of drawers – I must have made over £400 altogether, which is a promising start to the £147.06 challenge. I’ve always found Gumtree very straightforward and quick to get things listed, especially because I’m of an age when online selling used to involve uploading photos, (slowly), to a PC, and going through a long and complicated listing process. Gumtree really isn’t like that.

Listing something to sell on Gumtree takes literally minutes and if you have a few things to sell then even better, as you can whizz through photos of everything all at once. I use the Gumtree app, which means you can take photos on your phone and add them directly to your product descriptions, write up a little blurb, and you’re good to go. When you take your photos, remember to take them in decent light and make them look as appealing as possible. This isn’t Tinder you know – we don’t need topless photos in dingy bathrooms.

The product description – a bit like a dating profile – is probably the bit that could benefit most from a little bit of thought. The temptation is to just list details about the product but, like any good salesperson, what you actually need to do is create an aspirational idea BEHIND the product, get people thinking about themselves using it. View Post