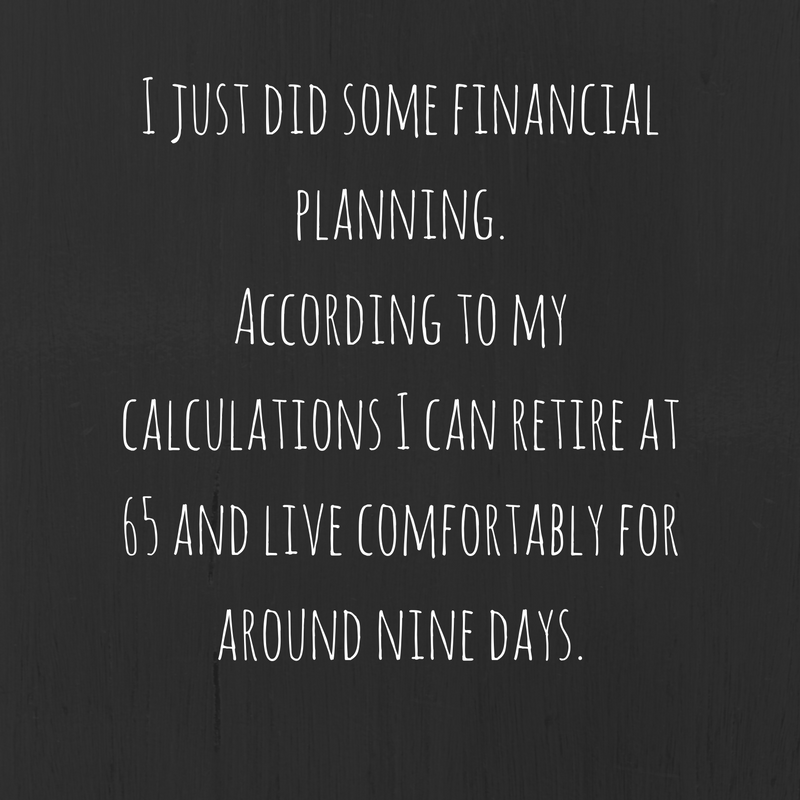

Until about four hours ago, I thought I had my pension situation relatively sorted.

I’ve always signed up for work pension schemes, and when I went on maternity leave with Belle, aged 24, (me not Belle), I also set up a personal stakeholder pension plan, which I’ve been paying into ever since. I’ve recently had a bit of a pension spring clean, put everything into one big nice pot, and upped my personal contributions dramatically to £300 a month. My pension fund at the moment is worth about £60,000, which in my head is a massive amount of money.

So when Aviva challenged me to live on my predicted pension for a week, I thought it would be easy peasy.

Turns out that in the world of pensions, £60,000 is not a terribly large amount of money at all, as I discovered after doing a few sums on the Aviva Shape my Future tool.

Doing some realistic calculations about the sort of lifestyle I’d currently be able to afford on retirement has been a massive eye-opener. I’d always imagined that retirement would be a bit like having a day off work, but every single day. You know how sometimes you get a day off in the week with your partner, while the children are at school, so you go out somewhere nice for lunch, maybe have a mooch around some shops, or go for a stroll and a piece of cake at a local National Trust property? That’s what I imagine retirement will be like every day. Plus maybe a spot of light gardening, because obviously by the time I retire I will know all the Latin names for plants. (I don’t know how this happens, but older people always seem to know them, so I’m assuming it will just pop into my head at some point?)

Oh, and the odd cruise around the Norwegian fjords.

To give you an idea, I created a little mood board for my retirement. View Post