It’s been quite a while since I did a free credit check on myself. In fact, it was about four or five years ago. My partner at the time was applying for a job that had very extensive checks involved and they were going to do a ten year financial check on me, and so I did one too, just to make sure they weren’t going to find anything incriminating.

At the time, I scored 999, which is the very top score you can get. I have to admit that I was pretty pleased with it at the time, as I’ve worked hard over the years to keep my finances squeaky clean.

But that was a while ago, and so when I saw a TV ad for Noddle, the credit check service that offers you free credit checks forever, (rather than one of those where you sign up for a trial and then forget to cancel), I felt like I should give it a go. I was also about to buy a new Mac on credit, and thought it would be useful to make sure I was good to go for that – I didn’t want that horrible embarrassment of a teenage PC World sales assistant telling me I’d been turned down. Nobody wants that. If you do run a credit check on yourself and it’s not good, there are things you can do to improve it – see my tips below – so don’t panic.

Even if you have a good credit history, running a free credit check from time to time is a really good way to help protect yourself from fraudsters. We share so much information about ourselves nowadays, that we do leave ourselves at risk. Think about it for a minute and I bet you can think of someone you know personally who has been the victim of identity theft, even if you’ve been lucky enough to escape it yourself.

You’d think that we’d be more careful as a result, but apparently not. According to Noddle’s research, more than half of us admit to throwing away letters with personal information on them without shredding them first; nearly a quarter of us have loaned their credit card to someone else, and 16% admit to keeping their PIN written down in the same place as their card.

Oops.

Checking your credit report helps then by flagging up any unusual or unexpected behaviour. It gives you information on current and previous creditors, so you can check that they match your expectations, and shows you other people or addresses that you might be financially linked to. If any of these ring alarm bells, you can then take action.

Free credit check from Noddle

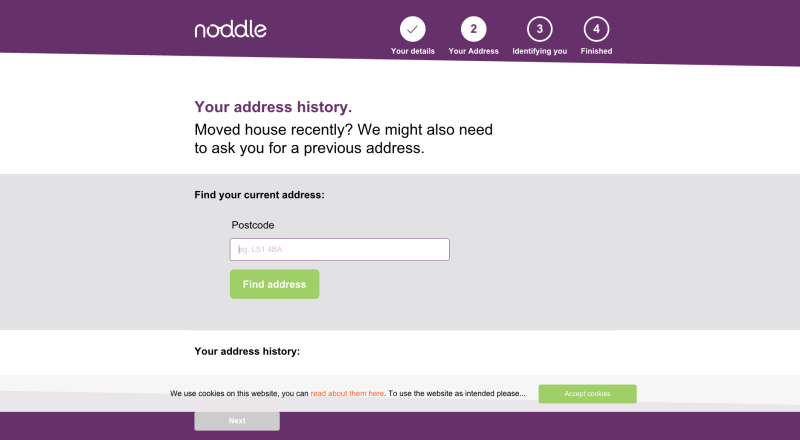

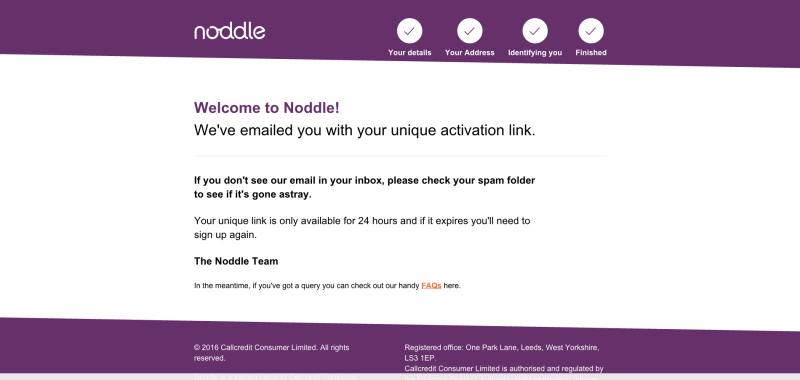

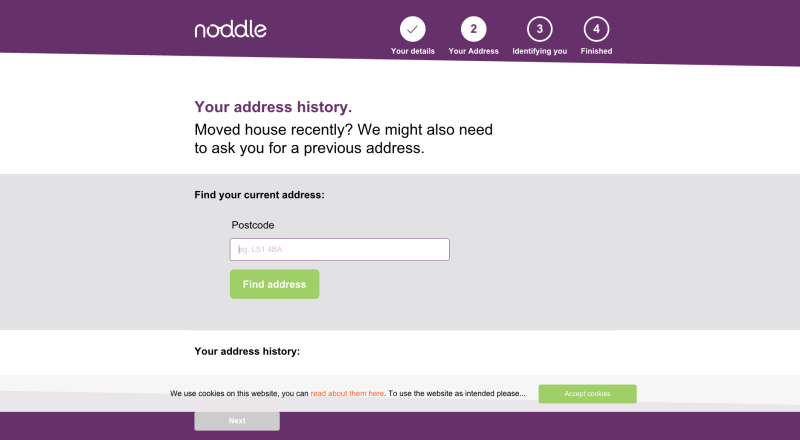

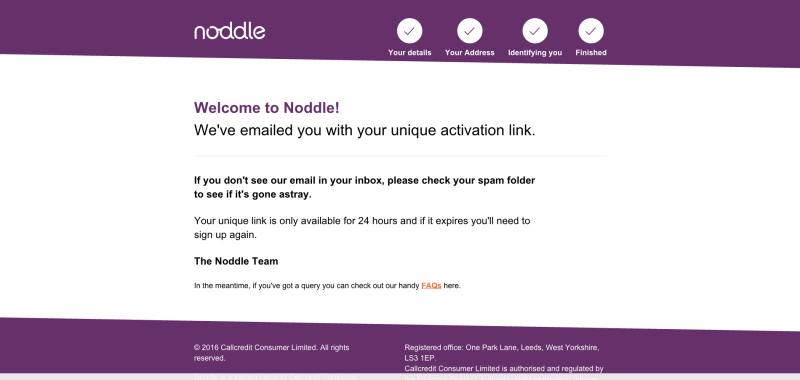

The Noddle set up process was really easy, and it took less than two minutes to enter all of my information. The confirmation process was really simple too – a series of specific questions about my finances that only I would know the answer to. Once the set up was complete, I was emailed an activation link, and it was time for the big reveal…

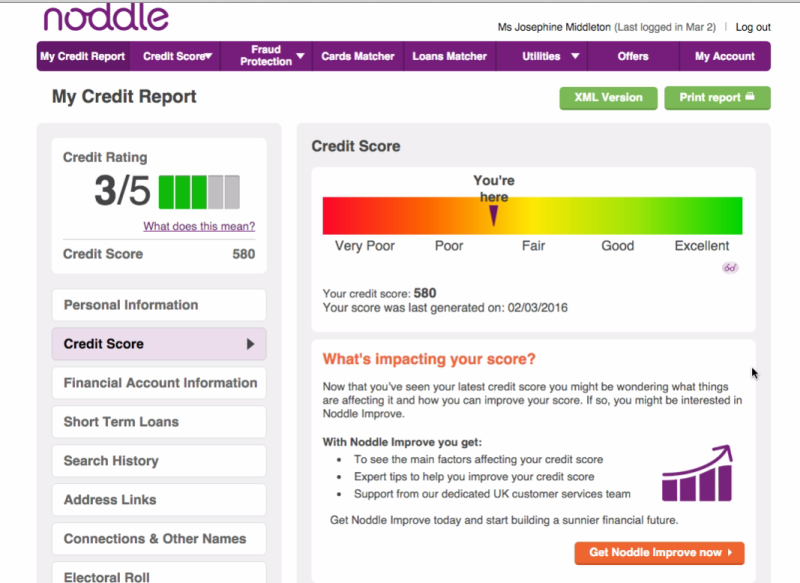

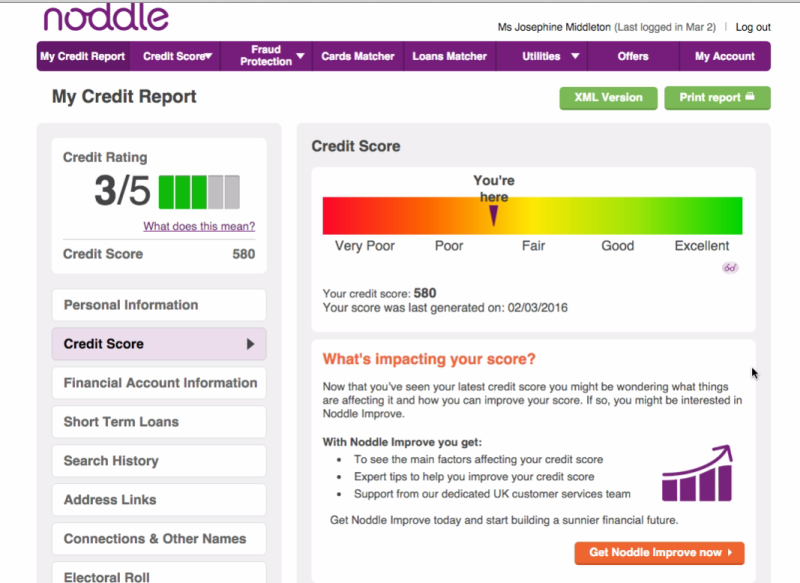

Now, I have to say, given my previous 999, that I was a little taken aback by this. 580?! I felt a bit like I’d got back a maths test from school and only got a C+, which, quite frankly, has never happened.

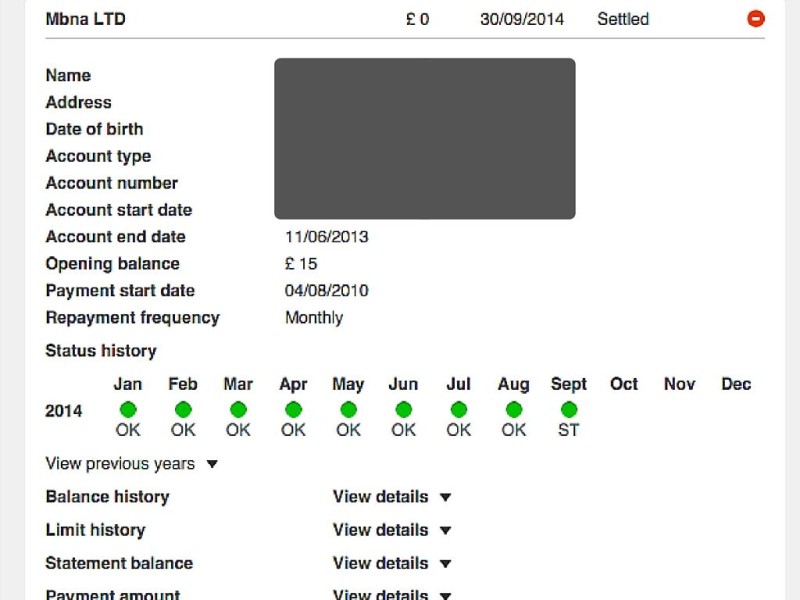

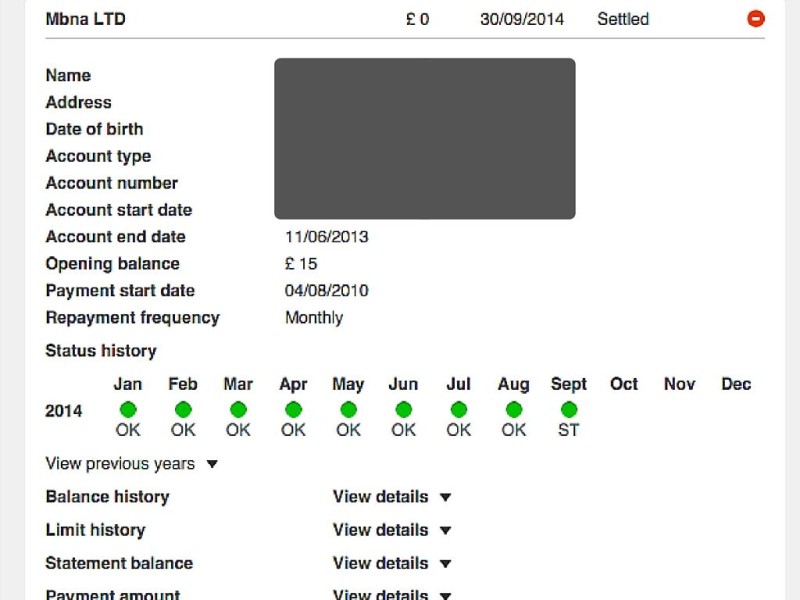

I ran through all the basics in the credit check report, and could see that nothing was amiss, so that was reassuring, as I had worried initially that perhaps there had been activity in my name that I didn’t know about. All of my payments were up to date, (clearly shown by lots of green dots rather than red ones), so I dug a little deeper to find out what might be the cause of the lower than expected score.

Tips to help improve your credit score

From my research, I could see that there might be a few factors bringing my credit score down. If you’re looking to improve your own score, do take these things into consideration:

- I’ve moved house twice since I got my 999. Frequent house moves can sometimes raise flags for lenders, and this can be reflected in your score.

- I have a couple of credit cards that I don’t use. You might not think that this is a bad thing, but apparently lenders look at the total amount of credit available to you, rather than just outstanding credit, and so if you have cards with high limits that you don’t use, consider closing these or asking or the limits to be reduced.

- I’ve had a lot of checks done on my account in the last couple of years. Weirdly, this too can impact your score, and it can happen without you really being fully aware of it, like when you get quotes for insurance. I also had a brief flirtation with matched betting last year, and so had checks from all the bookmakers I opened accounts with. Do keep this in mind as a factor if you’re looking for quotes or doing anything that involves applying for credit. One thing that might help with this is Noddle’s cards and loans matcher tools. Pop in some basic information about yourself, and it tells you which credit cards and loans it thinks you’d be likely to accepting for, before you apply. This doesn’t show on your credit record, so means you minimise the risk of being turned down and clocking up too many unnecessary checks.

- Repaying loans on time is another way you can improve your credit score. You will become more attractive to lenders because they can see that you can be trusted to pay your debts back on time. Taking out a bank loan can be a great way to improve an already good credit score. But not everyone is eligible for a bank loan. For those of you with a (cough!) ‘less than perfect credit score’, there are bad credit loans available for you, such as those offered by Flexy Finance. Used correctly, they can be an effective step on the way to a better credit score! What’s important is that you make sure you can afford to pay back what you owe on time before taking out the loan. Only borrow what you can afford and make sure you have a borrowing plan in place so you keep up with those repayments.

These are definitely areas of weakness for me, but there are other contributory factors to keep in mind too:

- How much credit to you have altogether? Higher balances can make potential lenders nervous.

- Are you on the electoral register? Get on it if not!

- Are you linked to anyone financially? A joint bank account, loan or credit card with someone with a poor credit record will impact your score too.

- Have you missed any payments on anything? This is obviously a significant factor, as are any CCJs against you.

The importance of online safety

The research from Noddle has shown that nearly four in 10 people (38%) in the UK have been a victim of fraud themselves. That’s more than 20 million people. That’s a scary figure isn’t it? This is not one of those ‘it happens to other people’ things, this is a very real problem. It’s a problem however that you can take measures to prevent:

- Don’t just throw away personal documents like bank statements and gas bills – shred them before disposing of them.

- Don’t keep your PIN number written down somewhere obvious, and especially not in the same place that you keep your card!

- Regularly check your credit report to help you identify unusual or fraudulent activity.

- Double check your social media settings and security – how much personal information are you displaying? How strict are you with friend requests? If you’ve a relaxed attitude to security and are sharing your full name, email, date of birth and home town, you could be setting yourself up for disaster…

I’d be really interested to hear about your experiences of using this sort of service and how it has helped you improve your credit score or protect yourself against fraud. If you’re not sure what your credit score is, sign-up to Noddle now and find out!

Sponsored post. Image of coins – Singkham/shutterstock.