Advertisement feature in association with Portify – the app that could help improve your credit score

We flew to Ireland a couple of weeks ago to see my sister and to celebrate my mum’s 70th birthday and before we went we all had to do PCR tests. Completing the tests and waiting on the results made me incredibly anxious. I couldn’t figure out why, but then I realised it made me feel exactly the same way I used to feel having credit checks done.

I read the test instructions carefully over and over, filled out all the forms, and sent them off. I nervously awaited the results, knowing it was completely outside of my control and yet at the same time worrying irrationally, as though the results would somehow be a reflection on my very worth as a human being.

If you’ve ever been in debt or had a bad credit rating then you can probably relate. I’ve talked a bit before about getting into debt as a single parent in my teens and early twenties. Doing your degree as a single mum at a university 50 miles away from where you live is never going to be exactly cost effective, and I lived with the consequences of that for quite a long time. Every time I moved house and had to complete credit checks through an agency I would feel that potent mix of dread and shame. I felt judged for my poor credit score, even though I knew the test were probably being done automatically by a computer. I felt the computer judging me.

Facing up to those debts and feeling like I’ve reached a financially secure place in my life is something I’m really proud of. I was pregnant aged 16 and have been a single mum on and off for 25 years. I’ve had very little financial support from ex-partners and honestly, raising a family alone isn’t cheap – the cost of single parenting is high. I’ve also been self-employed as a writer for 12 years, and didn’t necessarily give that a huge amount of thought before I jumped in and bought a second hand desk on eBay*, so finally being able to do things like buy a house feels amazing. You can get a mortgage for 1k a month here.

It’s a small house, sure, but it’s mine. I made it happen, no one else. I also finally feel like I have the freedom to start thinking about what I might like to save for in the future. I would absolutely LOVE to have a campervan for instance, and drive around having adventures and ideally solving mysteries.

Why is your credit score important?

Does it really matter if you have a bad credit score? Yes is the short answer. Your credit score not only impacts your ability to borrow money, (including basic things like getting mobile phone contracts), but it also effects how much it costs you to borrow money. If your credit score is poor then lenders will consider you a riskier proposition that someone with a good credit score and so will allow for that by charging you higher rates of interest.

This means that you could end up paying a lot more than someone else for borrowing the same amount of money. This is particularly noticeable for large, long term borrowing like a mortgage. Being charged just a percentage point or two more interest can add up to tens of thousands of pounds over the term of your mortgage. Try the Portify calculator now to see how much money you could save by improving your credit rating from ‘fair’ to ‘excellent’.

How can I improve my credit score?

It takes time to improve your credit score, but the good news is that there are a lot of things you can do to help it along the way. Simple things like making sure you’re on the electoral register, finding out your current score and checking your file for mistakes or erroneous links to other people can all have an impact.

If you long to improve your credit score and lose that shame around debt then I’ve picked out four key ways to improve your credit rating, including one that you might not even know about.

1. Face up to your financial problems

This sounds so easy but being in debt and having a bad credit rating is scary. I understand, I really do. You want to pretend it’s not there, ignore the letters, maybe even try to make yourself feel better about the shame by spending more money. You’re human, it’s normal to want to run away from something scary.

It’s not going to work though. Sorry. Debt isn’t going to go away. Your credit score isn’t going to miraculously improve if you ignore it. Moving house is only delaying the inevitable – debt catches up to you and it’s far better to turn and face it head on than to constantly feel like you’re running. Wouldn’t it feel good to not feel like you’re hiding?

What I learned from being in debt is that most companies are happy enough as long as you are honest. Stuff happens, money gets out of control, it’s okay, you just have to own that and deal with it. Take stock of your finances and write down exactly what you have going in and out. Get in touch with the people you are struggling to pay and lay it out for them. Make them a realistic offer – not a huge amount that you think will please them but that isn’t sustainable – something you can stick to.

Take charge. Be the boss of your credit score.

2. Do not miss payments

Well dur. This might seem obvious, but it’s absolutely key. Missed payments are one of the most significant things that effect your credit score and so making sure you pay all of your bills on time, from your broadband to your mortgage, is vital.

Making all of your payments on time is one of the most important ways to prove to credit agencies that you’re trustworthy and reliable, and it ties into the first point too – taking control, monitoring your expenditure and generally just not burying your head in the sand can help to make sure you don’t miss payment dates.

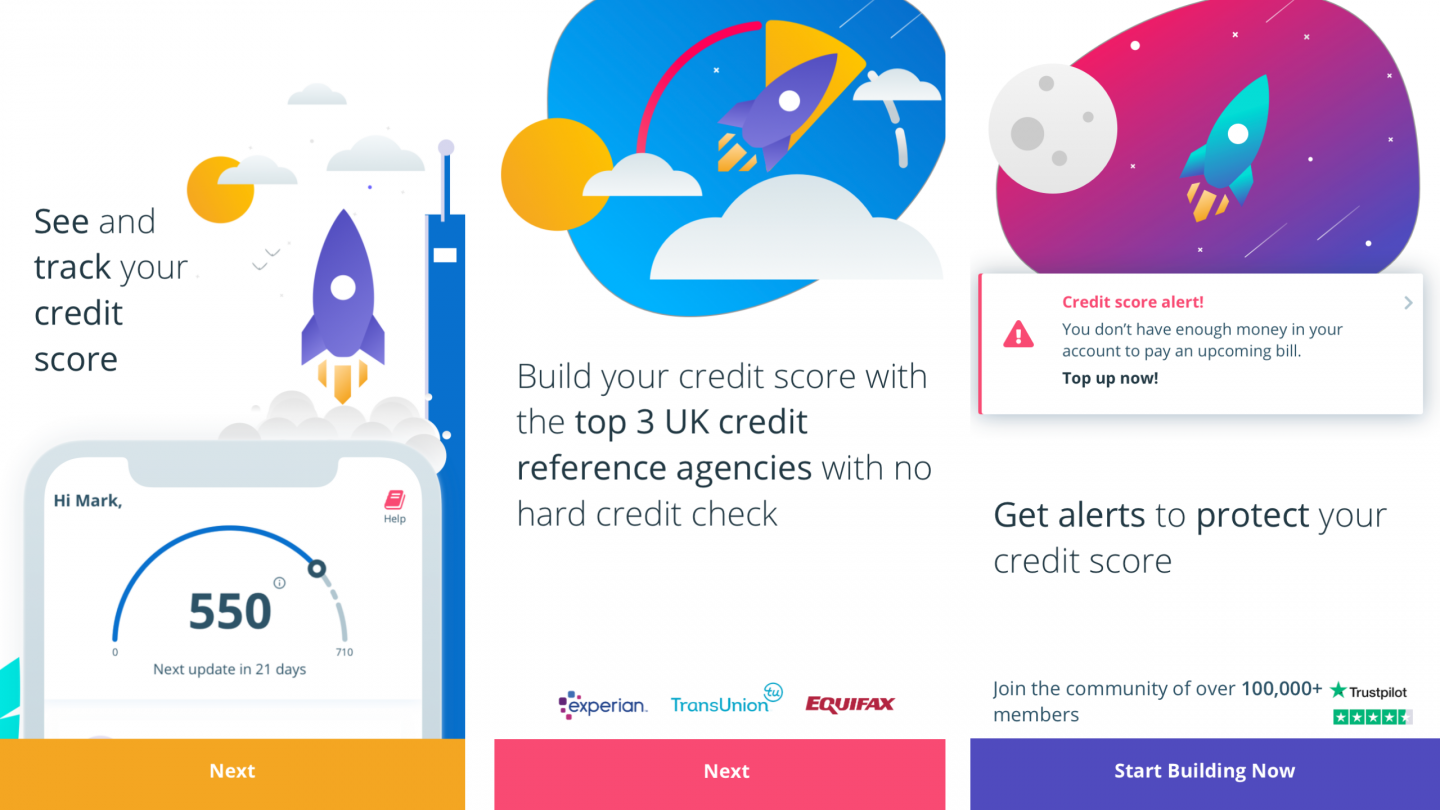

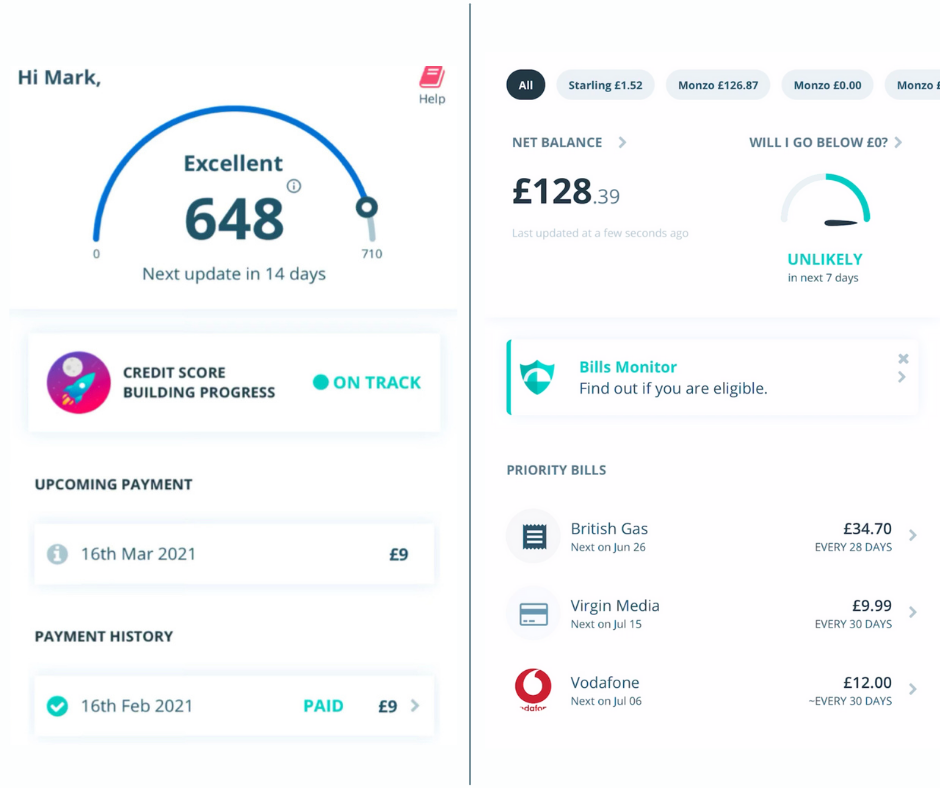

3. Consider a service like Portify

This is the sort of help that wasn’t around when I was in debt, but it’s something that you might want to consider if you’re serious about building up your credit score. The Portify app works in several ways to help you manage your credit rating, through free and paid for packages, and you can sign up in just three minutes.

At the free level, Portify empowers you to feel more in control of your money by tracking your income and expenses, and will alert you to bills that could impact your credit score. Through Open Banking, the app identifies your subscriptions and recurring payments and then sends you smart reminders to help you make payments on time. The app also has a handy expense predictor that will learn your financial behaviour and predict if any upcoming bills may push you into your overdraft.

Portify also offers a Lite and a Plus membership, based on flat monthly fees of just £5 or £9 and with no hard credit checks. These memberships could improve your credit score with the big credit agencies – Experian at the Lite level, plus TransUnion (Credit Karma) and Equifax (ClearScore) at the Plus level – and users typically start to see improvements after around three to four months. Building a good credit score takes time and consistency and you need a while to build up a positive payment history.

Portify is authorised and regulated by the Financial Conduct Authority, and the app currently has an ‘excellent’ rating on Trustpilot, based on 752 reviews. Users should maintain good financial behaviour when using the app to get the best results. Results may vary, visit Portify.co for more information!

4. Keep your credit utilisation rate low

Credit utilisation rate basically means how much of your available credit you’re using, and is another significant factor in how credit scores are calculated – a low credit utilisation rate is better than a higher one.

For example, if you have a credit limit of £1,000 on a credit card but a balance of £100, your credit utilisation rate is only 10%. You can improve your credit score therefore by avoiding maxing out on credit cards and paying balances off in full every month if possible. By doing this you’re effectively showing credit agencies that just because you have access to credit, you’re not rushing out and spending, you’re using that credit line responsibly.

Improving your credit score is a long game and it does take patience and determination, but it’s absolutely possible. Taking back control of your finances is such an empowering experience too, and getting to a place of financial freedom and security is wonderful.

So what are you waiting for? Take your head out of the sand, start taking positive steps to improve your credit score and you’ll be solving mysteries in your campervan in no time.

*Everyone knows that all you need to become a writer is a desk right? Like I said, not a great deal of thought…

Until I bought my first home I had no idea how important my credit score was

Author

I think that’s part of the reason it’s so important to talk about because a lot of people don’t realise it’s an issue until it IS an issue.