Advertisement feature in association with HyperJar

I’ve never been very good at pocket money. When my kids were younger I would start off with great intentions, and then I’d have a day where I’d feel all carefree and expansive and like nothing really mattered, so I might as well buy them treats.

My children quickly cottoned onto these moods and called them ‘put anything in the trolley’ days. With Belle now, even though she’s 19 and earns her own money, it still happens. In Tesco just last week I somehow ended up buying her the official Taylor Swift magazine. Guilt I suspect, for the fact that I was going away. She saw weakness and she made the most of it. Good for her.

When Belle was younger we did have a brief fling with a pocket money app where kids could get their own card. Belle loved this, because she’s always very much doing things like pressing the buttons for me at cashpoints, but the fees for it made it seem a bit silly – why was I spending twice as much as I needed every month, just for the sake of a few pounds on a card? Surely it made more sense to just let Belle have it all in cash? I think we ended up actually opening a full blown bank account in the end, just because it was cheaper.

If your kids aren’t old or wise enough to have their own bank account or debit card but you still like the idea of teaching them about money and how to save and spend it, then HyperJar could be the answer.

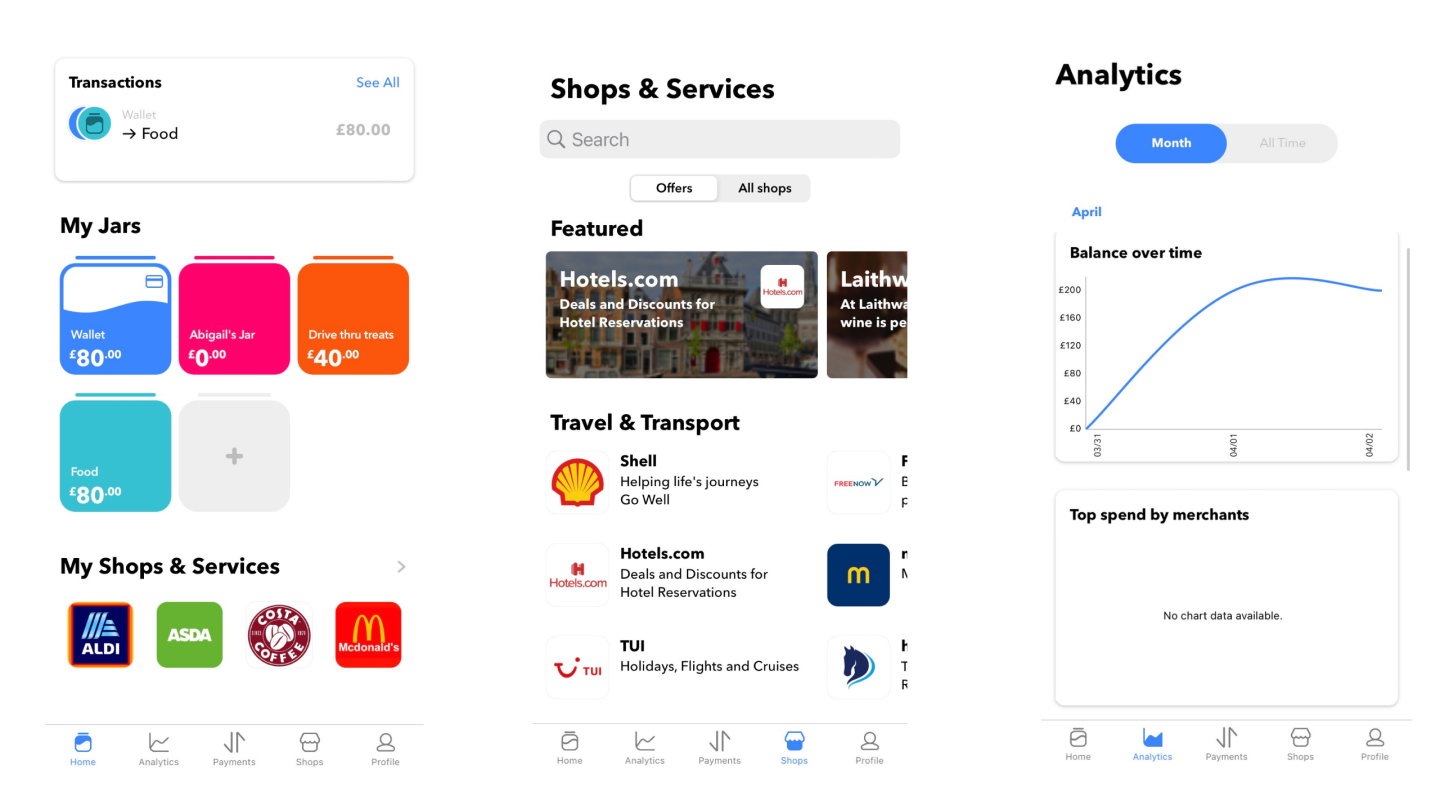

HyperJar is a totally free money app that adults can use to budget, save for specific items and events, and even earn bonuses on spending. It works very visually by allocating money to different jars, which you create according to how you want to spend your money. I know finances can be daunting and that many people, including Belle, find something visual much easier to understand than spreadsheets.

How HyperJar works

For the grown ups, HyperJar works like this:

- You transfer money into your HyperJar account. (This money is held by the Bank of England, not HyperJar, so it’s quite safe.)

- You set up jars for different areas of spending, like food shopping, treats, or long term savings like holidays.

- When you want to spend money from your jars, just link the jar to your HyperJar card, (this can be real or virtual), and spend directly from the jar.

- You can cut out the pre-transaction linking part by setting up retailers to automatically link to a particular jar. For example you could link Sainsbury’s, Tesco and Aldi to your food jar and anytime you spend money with one of them it will automatically come from that jar.

The principle is a simple one, designed to make you more aware of what you’re spending your money on and to help you budget more effectively. There are lots of cool features too, like the ability to share jars with other people – very handy if like me you’ve hate the idea of a joint bank account but also have someone you want to split costs or share savings with.

There’s also the option to earn 4.8% AGR on money spent with certain partner retailers, by setting up special jars just for them. Current retailers include people like Shell – we know we’re going to buy petrol after all – or TUI – ideal for holiday saving.

Once you’ve been using the card for a while you can also look at analytics and see where you’re spending. I might be tempted NOT to look at that bit – I’m not sure I want to know I spend a gazzilion pounds every money at the Costa drive thru.

All sounds useful right? Right. What I want to tell you a bit more about though is the free kids pocket money card.

HyperJar free pocket money card

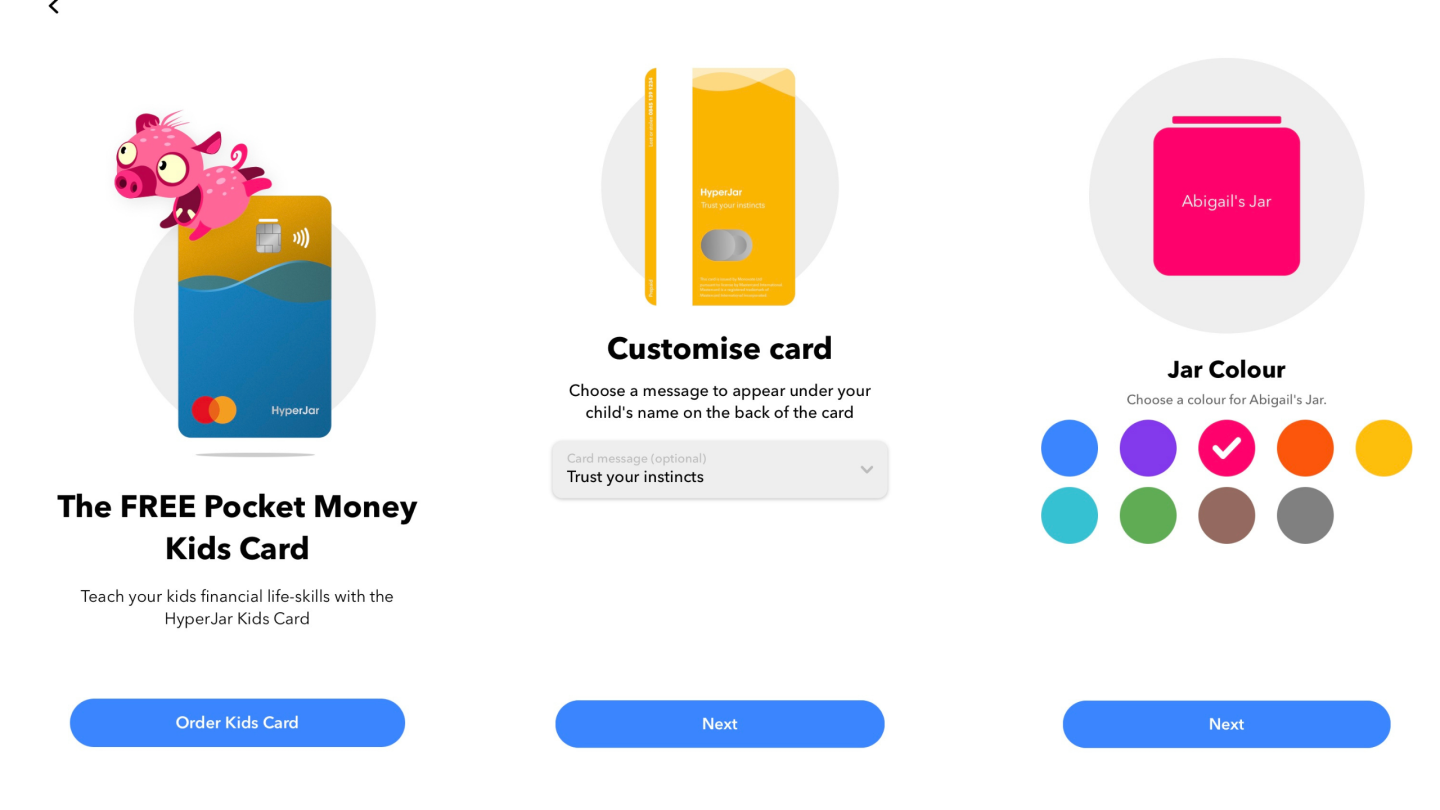

If you want your kids to learn about financial independence but still want to be able to monitor or control their spending then the HyperJar free pocket money card for kids could be just what you need.

Kids’ HyperJar accounts are suitable for children aged 6-16 and are linked to your own HyperJar app, so you always have full control. Setting up HyperJar for kids is very straightforward – simply enter your child’s details, customise their card with a message if you’d like to, and then create a jar to go with it. Their card will come in the post and in the meantime you can transfer money into their jar, just like you did with your own jars, ready to use.

Once you’re all set up, you can explore what makes the HyperJar pocket money app so cool.

It’s a totally free pocket money card

No fees to set up the app, order a card or transfer money between accounts, meaning every pound you spend goes directly into the pocket money jar. HyperJar is actually the UK’s only free pocket money card, which is a bit bonkers when you think about it isn’t it? You have to be over 11 years old to open your first current account with a debit card, but with so many places now only accepting card payments it seems unfair that younger kids get penalised by everyone but HyperJar.

It’s also great for holidays as there are no FX fees when paying in different currencies. This would actually be really useful for me too as my current account card charges me a £1.50 fee and a percentage charge on top every time I use it abroad. (The same does apply to the adult card.)

You can control where they spend their money

Do you worry that giving your child a pocket money card would mean they’d rush out and spend it all on McFlurries? Don’t! With the HyperJar pocket money card you can ban selected retailers if you don’t want your kids spending there, and you’ll be able to see every single transaction, so you’ll always know where their money goes.

You can set spending limits if you want to, but because it’s prepaid, you never need to worry about them overspending, getting into your bank account or anything like that.

Kids get their own app too

When you order your child’s HyperJar card, you’ll be given a QR code. When you child downloads the HyperJar app, enters their date of birth and the app realises they’re a child, they’ll be prompted to scan the QR code and access an exclusive kid’s version of HyperJar. The kids’ app includes just some select, age appropriate retailers, and kids can set up their own jars and spend from these. You’ll always be able to see what they’re doing via your own HyperJar app.

Create different jars for different purposes

You don’t just have to have one jar linked to your kid’s pocket money card, you can set up multiple jars with different purposes and share them with your child. They might want to have a jar for savings for example, if they’re saving up for something special, or you can set up jars just for specific retailers. If for example you want them to be able to pay just for travel, maybe to and from school or college, you can do just that, creating links with travel providers through the app so they can only spend with them.

HyperJar is great for older children too

HyperJar isn’t just about giving pocket money to your young children for the thrill of using a card to pay for their latest squashmallow, it’s great for teenagers too. Kids up to 16 are eligible for a HyperJar kids card, and from age 13 they can even add it to Apple Pay or Google Pay – HyperJar is the only kids pocket money app that does this.

Older children of course can get their own bank account and debit card, but if you want to still have a little bit more control over their spending, or just want to be able to keep an eye on it if necessary, then HyperJar is really useful.

Get HyperJar now and spend life better

If you like the sound of taking charge of your money, setting up some much needed savings and signing up for a FREE kids pocket money card then you’ve got literally nothing to lose. Join today, enjoy all the features of HyperJar free for life, and start spending life better.

Such a great thing!

Danielle | thereluctantblogger.co.uk