Mortgages are apparently at their most affordable level in 14 years. This could be good news for me as it was around 14 years ago that my Gran offered to lend me the money for a deposit for a house and I said ‘Nah, that’s alright, I’ve got loads of time to worry about things like that.’

D’oh!

A couple of years later and the rented house I was living in had doubled in value and it appeared that I had missed the property boat for good.

(I doubt I could even afford a boat.)

Starting my family young has made it even harder to get on the ladder as I don’t have the option to begin on the bottom rung. My children have shared a room before, but they were both under ten – I’m not sure it’s quite as fun at 11 and 18. To be honest I’m not sure it was terribly fun for Bee even at nine.

So, could there be a light at the end of my chucking-money-away-every-month-on-rent tunnel? I thought I should investigate.

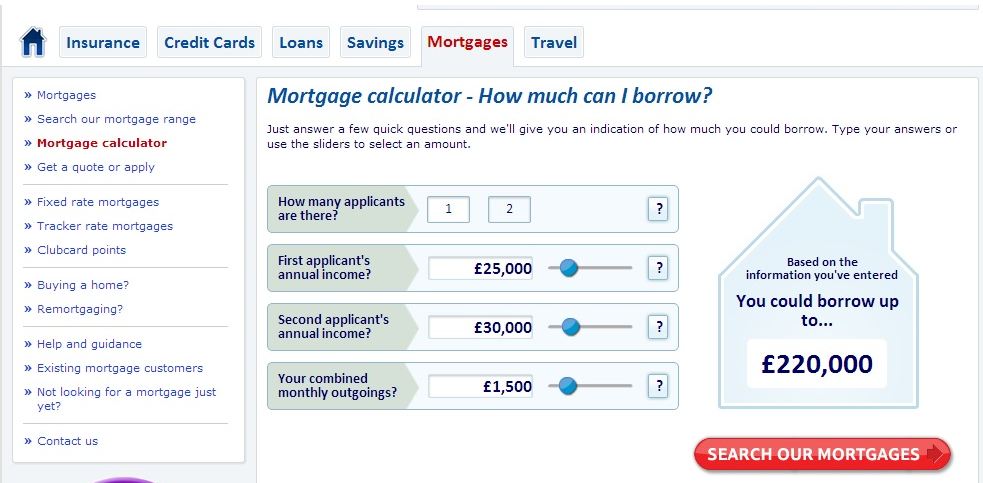

There seem to be three elements to a mortgage. The first is how much can you borrow? This is based on your income, and you can get an idea of this using a tool like Tesco’s mortgage calculator.

This part went relatively well – between us Boyfriend and I have a decent enough income, and we could probably afford to borrow enough for a house, so long as we didn’t mind moving out of the city a bit. Unfortunately, I do mind moving out of the city a bit. This could be a pretty big stumbling block, but let’s focus on the mortgage for now. I also chose to brush over the fact that I am self-employed, as I’m not sure how this impacts an application.

The second thing to consider are the repayments. Again, this wouldn’t be a problem. We currently pay over £1,000 a month in rent for a normal size 3-bedroom house in Bristol, and the same repayments on a mortgage over 25 years would equate to borrowing around £200,000.

So far so good.

The third step though is the tricky bit. A deposit. I have checked the jar we keep on top of the fridge and it has around £11.26 in it. Based on this as a 10% deposit, we could afford to spend around £110. This is not ideal.

Step three I imagine is the sticking point for many families and can become a horrible vicious circle. You could afford the repayments, you could get the mortgage, but because you’re paying out so much in rent every month you simply can’t afford to save. Once you have children, moving back in with your parents for a year or so isn’t really an option, and because of the size of house you need you can’t start small. Without wealthy parents or a substantial inheritance on the horizon, how are normal families meant to ever be able to afford to buy a house?

Looks like I had better keep adding to that penny jar.

Do you rent or buy your house? If you were buying for the first time now, would you be able to afford it?

We had this problem 8 years ago but we got help in the form of a housing association loan.

We got to choose our house and they leant us £30k which we pay back when we sell with a small percentage of the profit. It’s called the homebuy scheme and is fab BUT it does have its drawbacks!

We are now firmly stuck on the bottom rung of the ladder needing a bigger home. If we sell and pay back the £30k – that takes us back to square one so couldn’t afford to get a bigger house than we already have.

The new government help to buy scheme looks great and we need to make an app with a financial advisor to see if it could help us but the stumbling block is that homes need to be new builds. In our area all the new builds are 4 bed (we need 5) are tiny and are stupid overpriced as close to Sandbanks!

If i was buying for the first time now there is no way we would be able to afford the deposit. Luckily we bought before the crash and got a 100% mortgage, something that you certainly can’t get now.

We made enough money that not we have a decent amount of equity in the property but we were just lucky really. My little sister lives in London and there is no hope in hell she will ever be able to buy unless like you say they get a windfall.

We’re currently trying to save for a mortgage and like you say it’s hard trying to save when you have to pay out so much rent every month. Luckily we don’t have kids yet or I’d feel it was completely impossible. At the moment we’ve worked out a 2/3 year saving plan that should give us enough for a deposit. Its unfortunate that all the new Goverment schemes to help people get on the property ladder seems to only exist In England at the moment and as far as i’ve heard are not planning on extending to wales.

It’s lucky in a way that the area we live in has such low property values, we can get a decent sized 3 bedroom for around £50000 to £60000 and there’s even some 2/3 bedroom houses going for £30,000 however the area is really rundown/not the sort of place you want to bring a family up in so it means we only have to find £10000 for a deposit at most compared to most areas I’ve seen which need £20,000 and up.

We bought this house last year, and I’ve still to sell my previous house, only a couple of miles away. We’re very lucky in where we live that we can afford to buy, and to have bought this house without worrying too much about selling the old house (though it would make things easier, yes) I’m very aware that there’s only a few places in the UK we could have afforded to buy a house like ours. It’s a big decision, but it all comes down to which is more important to you, the location or owning. I lived in the middle of the city, it took just as long to get to work as it did living 20 miles out. And I saved a fortune, my mortgage was about half what I was paying in rent.

I dunno I reckon it depends where you are buying. A friend said they would never be able to afford to buy, they earn four times as much as us so I had to ask her why. She wanted to live in one of the most expensive areas, 4 bed min, large gardens (front and back), two bathrooms..the list went on. So yer I guess she would have needed 500,000! For us, buying meant we were spending much less then our rent (like £200 less a month) OK we did buy a house that needed A LOT of work and yep it’s in one of the most poorest areas but if we sold it now we would make a profit even in this climate . Although it’s not really about that as we are planning on staying in the area a long time. My parents on the other hand have never bought but always rented really lovely places in really lovely areas that they would otherwise never get to experience so of course as with everything there are pro’s and con’s! xx

Really interesting post. Couldn’t agree more the big stumbling block see,s to be the deposit. We are a young family & we started discussing mortgages this year and have decided we better start saving for a deposit now if there’s any chance of us getting our own house in the next 5years. It is extremely difficult and seems that mortgages are aimed at the wealthy with the idea to control and keep the less fortunate in the slums of the city.

I’d bought a flat on my own before I met my husband, then the house prices went up and when I sold the flat we were able to get a decent deposit on our house together. We were both working full time then (the children came later), we were able to get a good enough sized house too so we were very lucky. It’s just as well we have enough space now though because we couldn’t afford to move since we only have one main income. I feel for our children though because I know for most people, it’s the deposit which is the biggest stumbling block.

It is totally depends on the place where you are buying the property. I know that very few areas in UK are affordable to buy a house like ours. Luckily we don’t have kids. So we can save money for at least 2 years. That would be helpful for us in future. Anyhow here I got good information about selling and buying properties and Mortgage a property. Thanks for sharing such an informative post.

We too are in the same boat. We are privatley renting and have 3 children and the cost of living is hurrendous. The only option for us to get a deposir is asking family members. How would you guys feel about having to ask your family? X

Aw, this was a really nice post. Taking the time and actual effort

to make a superb article… but what can I say… I hesitate a whole

lot and don’t seem to get nearly anything done.

my web blog: how to do a mortgage calculator in java