Over the last few years I’ve started doing this thing whenever I travel anywhere of bringing Bee back some local currency as a present. (I buy myself tasteless fridge magnets, but that’s probably a whole post in of itself – a treat for another day.) Not only does this tradition mean I have a useful thing to do with leftover holiday money, but it also means that I am technically giving her cash, which she always likes.

(She has from time to time, when things have got desperate, thought about exchanging it all for pounds, but I think she’s been disappointed by the value of her Vietnamese Dong.)

Photo by Keegan Houser on Unsplash

Although this is a very lovely and thoughtful gift, it’s undermined by the fact that my approach to travel money generally is a bit backwards. In my head, people who order foreign currency in advance for trips are OLD PEOPLE who are just overthinking things. ‘Look at me,’ I think to myself, ‘getting cash out at an ATM and casually paying for things like souvenirs or fun times abroad on my card like a pro-traveller.’ Then I get home and realise that my bank charges me a fee AND a percentage on all non-sterling transactions and I realise what a doofus I am.

And then I forget about it until the next time I go abroad and the VERY SAME THING happens all over again. If I ever do think to buy foreign currency in advance then I just go into the post office because I really don’t know how it works otherwise. Thinking about it I really don’t know where the cocky attitude has come from as I am clearly RUBBISH at the whole thing.

With our summer trip to America though I wanted to be different. I knew Belle had plans to bring home a huge variety of snacks, (she requested a trip to Walmart and the extra large suitcase especially), and that she wanted to try out a lot of different American fast food outlets. I didn’t want to be forking out fees every time she bought a packet of unusual flavoured chewing gum or a taco so I needed cold, hard cash.

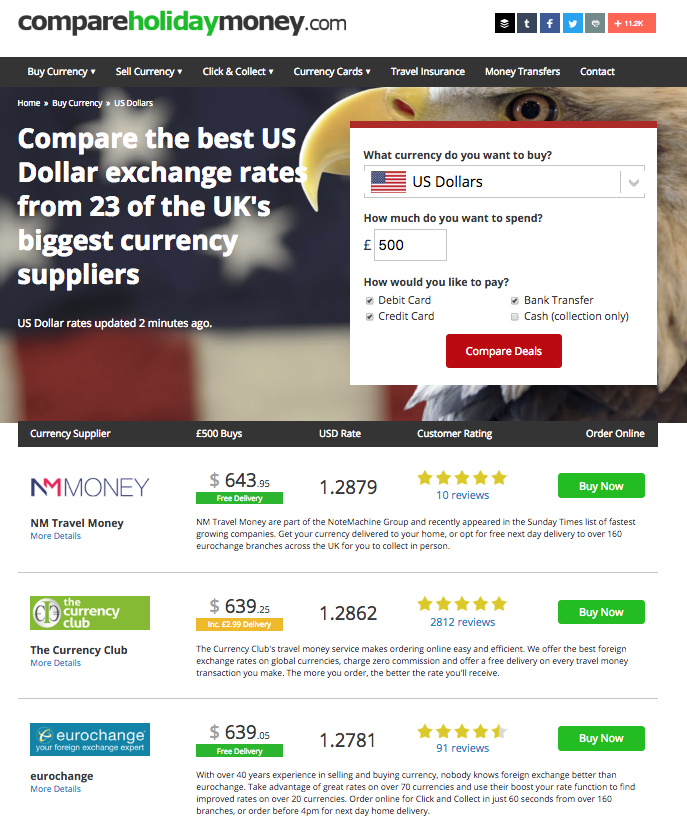

I decided to try out CompareHolidayMoney.com. Partly because they asked me, true, but also, what brilliant timing! It was like fate had seen all my non-sterling transaction fees and stepped in before I accidentally doubled our holiday snack spend by not planning ahead. Plus CompareHolidayMoney.com is Europe’s biggest dedicated travel money comparison service, so if you want to get the most bang for your buck, or dollars for your pounds in my case, then it really is the place to go.

CompareHolidayMoney.com lets you compare deals on foreign exchange rates from loads of different providers, gives you ratings for each based on customer reviews and is transparent about delivery costs. You could save 10% or more on the cost of your travel money by comparing prices using the site, not to mention saving on all those card fees, so it’s well worth a look.

I opted for the top one – NM Money – as they were offering a great rate, had five star reviews and included fully insured, free next day delivery on orders of £500 or more, ideal for me as I’d left it pretty late to even think about currency.

The whole process took just a couple of minutes, way less time than it takes to queue up in the post office, which left me feeling rather silly that I’d never thought to do it before.

So now our currency is on its way we can concentrate on the important stuff, like which to visit first, Walmart or Taco Bell?

Post in association with CompareHolidayMoney.com