I was having a disagreement with Boyfriend the other day.

It all started because I have been taking part this month in the Great British Budget challenge and have been using Money Hub in the new YourWealth app to get my finances in order. If you are the sort of person that likes lists and charts then you’ll love Money Hub. You can test out all sorts of different scenarios to see the impact of certain financial decisions on your future wealth, as well as budgeting for the day to day stuff.

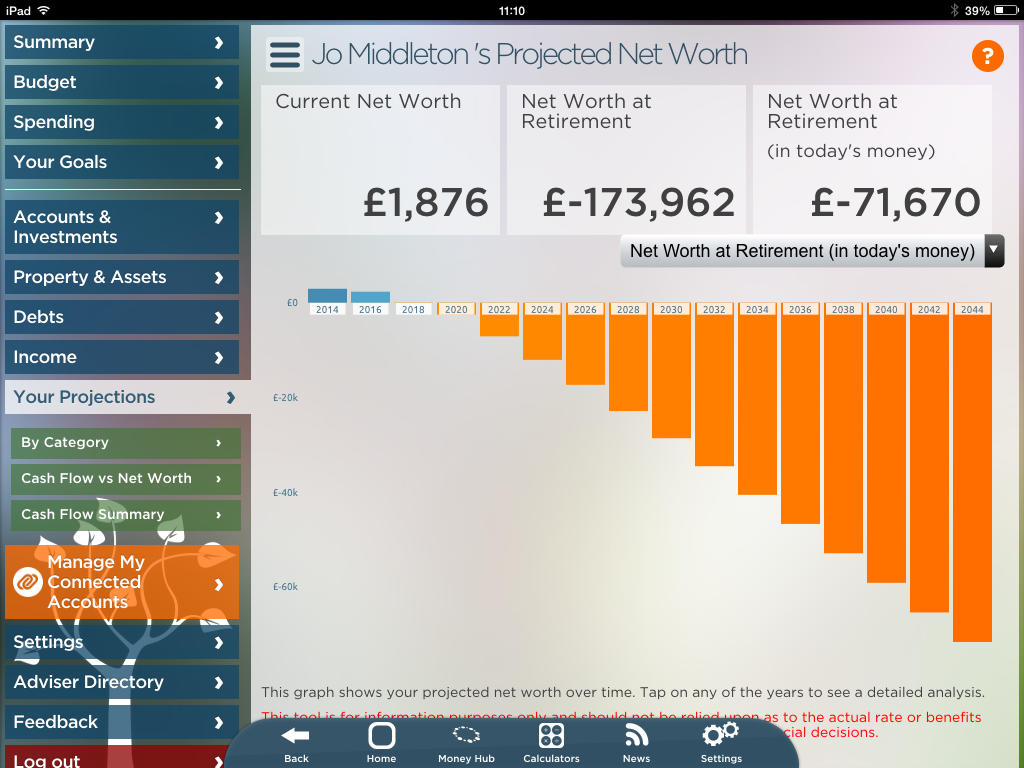

For example, based on my current earnings and level of spending it is projecting my net worth at retirement to be -£173,962.

*whistles casually*

Less depressing though is the monthly budgeting tool, which allows you to set a budget for your regular expenses and then track your spending against each. Boyfriend scoffed when he looked at it, saying that £135 for our gas and electricity was way too much. I made a very self-important speech about him not understanding the true cost of things in today’s economic climate, and then snuck a look at my online utilities account to check.

My investigations proved fruitful – we’ve been overpaying on both bills for about a year, leaving us over £500 in credit.

Just don’t tell Boyfriend he was right and I was wrong. I will spend the money on gin and he’ll never know.*

It just goes to show though how worthwhile budgeting can be! How are you when it comes to managing your money?

*It’s exactly this attitude that means my estimated net worth at retirement is -£173,962

Glad you’re finding the Money Hub useful – that’s a great saving on your bills!

We never used to budget and just lived from one week to the next. That was until a friend of mine asked why we couldn’t go out and I said ‘because the mortgage is due this week’. She explained how they budgeted their income and I sat down the same day and worked out our budget. We started setting aside a certain amount every week (paid weekly in those days…30+ years ago). After about 2 months we were no longer overdrawn and have never been ever since.

I now fear how we’re going to cope when we retire … him in 7 years and me shortly after…

Author

That’s a great story Su – shows what an amazing difference a spot of planning can make. Have you made time to think properly about retirement and work out what you’re income is going to be? There may be things you can do? The Money Hub site has lots of tools and calculators and what not.

good grief that seems a lot of rent per month, more than my total monthly income. you can be pleasantly surprised even by changing your package for gas and electricity without even changing company. when we last did it we saved 25% of our annual costs, price comparison sites are a god send. Sadly here we have no choice, electric only in the village and our time clock is owned by the power company so we cant change.

If you save your £40 a month till you retire you may be worth a bit more.

Author

It is Elaine, although cheaper than our last house!! That’s what happens when you dedice to live in the centre of Bristol. Opps!

I’ve been wondering if we are over paying on bills how did u find out?

Author

I just went and checked my online statements and it turned out that the direct debit amount they had been setting was too high – we weren’t being overcharged, just paying too much towards it every month. Are you thinking you might be being charged too much? Maybe if you know your neighbours well you could ask them roughly what they pay to see if yours is consistent?

App sounds good, might give it a whirl as I love my lists!

Author

If you are a list and chart fan Lee then it’s definitely worth a look!

Wow, such a great tool to use, thank you. I am glad to see there is someone out there who is as errrr, financially challenged as me ;) I am of the ostrich school of finances. So I hope this will help!

Hi, we’ve just changed suppliers, I’ve always been the one who sorted the bills, my husband was off work this week and got a bee in his bonnet about our gas and electric, which was due to come out of it’s one year fixed term, we were paying £125 a month and they wanted to raise it to £153! I’ve always stayed with the same company, but read recently that it’s better to use the smaller firms, so he went on a comparison site and we’ve gone with a smaller firm, our monthly bill has gone down to £79! And not only that, the company were with owe us £300? Funny that, they owe us yet they wanted to up our bill? The more of our money and the longer they have it the more it makes them in interest.

Did you include the biggest drain on household finances, which is used with greatest inefficiency? Look out the window, yes out the window, at the car parked outside. On average the UK’s private cars stand still, empty and parked for 96% of the time, and it costs £4000 per year upwards to finance, and operate. Think it through – if you can get to and from work by taxi, public transport, bike or walking for £10/day, you can afford to spend £1500/year on car hire (brand new cars, which are someone else’s problem when they break down and go back when you need to ‘park’ them).

Some things do have to change. You’ll buy from local shops, get items delivered (often free of charge by suppliers competing for your business), and by buying in bulk, or through the knowledge of fares and timetables, learn how to save time and money on your daily operations. I am staggered at the prices that tourists pay for car hire, going to websites, with my knowledge of local rates and deals. I had a car for 2 days (an economical low emissions model) for under £40 in hire charges, and drove 400 miles – at the cost of under 25p/mile. Many local shops can match – and for some items beat – the supermarkets for price, quality and freshness, and often offer regular customers a feature that no loyalty card can – forget your purse and you can often pay when you come back next time.

I’ve not owned a car full time since 1976, and when I inherited my late father’s car, I was glad to sell it some 6 months later, freed from the steady stream of bills that it generated. After a long (12 year) wait I have been able to join a car sharing club, in my city, and have 24/7 access to pay as you use cars and vans both from the streets near to my house, and any other location, UK-wide where the car club operates. I often use a car club car when visiting London, more as a place to ‘park’ my bags than for the transport value – cheaper than the left luggage, and avoiding the embarrassment of where to put a suitcase and outdoor coat when visiting offices designed solely for visitors arriving by car, arriving with a briefcase wearing a light suit.

Bike hire is a further element on treating your travel consumption bill to the same scrutiny you have obviously applied to your utilities consumption bill. One couple found that when a new tram line reached their area, they could both commute using the tram, and one then used a folding bike to get from the tram stop to her workplace. They sold the 2 cars they were using, pocketing a 1-off cash sum of £15,000, and saving around £7,500 per year in annual costs. Of course that was not the nett saving, as both required an area-wide Travelcard for the buses (around £1,200 each for unlimited tram and bus (and often local rail) use). They then had a generous budget for taxis, and hiring cars – the grubby van to shift garden rubbish, the economical small car for long lightweight trips, and the convertible sports car for those special summer days and treats. I point out that for around £400/day you can get a Lamborgini should you want to make a really special impression on someone. Corporates too gain – many Councils have now dropped paying ‘grey fleet’ mileage at 45p (and more) per mile, giving employees car club membership, both for work, and as an employee benefit and making big savings – typically 30% – often more on their employee travel expenses budget, and reducing their carbon footprint, substantially (see Energy Saving Trust case studies)

You’ll see this transport budgeting working in many areas where low incomes deliver low levels of car ownership. The weekly shopping trip sees the taxi used as the low cost way to get a mass of shopping home, and the blinkered thinking of those designing the supermarkets of placing bus stops and taxi ranks some distance away, and the car park a the key connected area. In Drumchapel dumped shopping trolleys cutter the ground by the road where the taxis stopped – some 50 metres away, in Inverness a Highland pragamatism put a trolley park at the bus station, compared to the Gyle or East Kilbride where trolleys rolled about loose and bump into the buses. I have a theory that many trolleys go missing simply because the loss of £1 (or the ‘forgery coin’ bits that are freely circulating) is better value than the taxi fare back to the house or flat, and then you simply dump the trolley as someone else’s problem.

Yes a lot of very skewed thinking thanks to the way many lives have been so narrowly focussed around the car as the sole means of transport.

Finally – no brainer win for so many London commuters, especially those using rail comes from an example of an early user of the Brompton Dock scheme – which had its early trials in 2009, over a year before the Boris Bikes. This guy, living in Surrey, and working in W London, was taking over 100 minutes to make 3 train journeys, changing at Clapham Junction and West Brompton. He now takes 70-75 minutes, getting off the train at Clapham Junction, and riding directly from there, saving at least £1,200/year on the ‘London Zones’ travel, which amply pays for the bike hire, and losing weight/getting fitter in the process. At a couple of sites the employer/institution runs the bike hire scheme, because of the money it saves on providing parking spaces (up to £9,000/year), or a high frequency inter-site minibus service (a 7 figure bill).

Happy to provide a full piece…..

£500 in credit.

This is exactly why companies want us to pay by DD and have bills online.

The majority of people don’t check there accounts monthly

If you move away from the big players then you get interest on any credit balance! I moved to OVO . Can control my direct debit as I want and I get 3% interest on any credit

I changed to OVO because it was the cheapest. I have since found that it is so simple to use. Once a month you send them your readings and you can check how much electricity you are using compared to last year and also comparing you to a similar size house. You can look at what your currect direct debit is per month and they also suggest a revised figures if this is too high. I have changed mine downward three times in months and it is very simple.

If you can’t manage your income and pay more than needed on energy DD’s it is you who have not checked what you are using, simple to read meters at end of each month and work out your own DD charge, some companies do variable DD which means you pay each month for what you have used, beware large bills in winter small in summer. I have never had a problem setting the DD with any of the energy companies but I have years of recorded consumption to back up what i offer to pay, never like to get into debt but allways a little overpaid.

Best way to manage your money … is to study hard … get good qualifications…. work like the clappers 80hr a week if you need to… build up a pension pot… save every penny you can… have simple hobbies … and dont drink and smoke your money away… do these things and you’ll be as rich as a king and able to retire at 50.

Their as you understand my head! You seem to learn a great deal somewhere around that, as if you had written a guidebook from it or something like that. I have faith that you merely can employ some Per-cent to stress the content property a bit, but besides these very, that would be ideal blog site. A superb understand. I am going to definitely be back.